Climate Change Committee Doubles Down on Unrealistic Net Zero Costs Under New Chair

The new chair of the CCC is now complicit in the Carbon Budget deceit

Anyone who was harbouring hopes that the appointment of Nigel Topping as the new chair of the Climate Change Committee (CCC) would herald a new era of realism has had those hopes cruelly dashed. Last month, Shadow Secretary of State for Energy Security and Net Zero, Claire Coutinho, wrote to Topping challenging the cost assumptions in their recent Seventh Carbon Budget (CB7). On Tuesday last week, he responded with a rambling letter full of tendentious drivel and deflection.

What did Claire Coutinho Ask for?

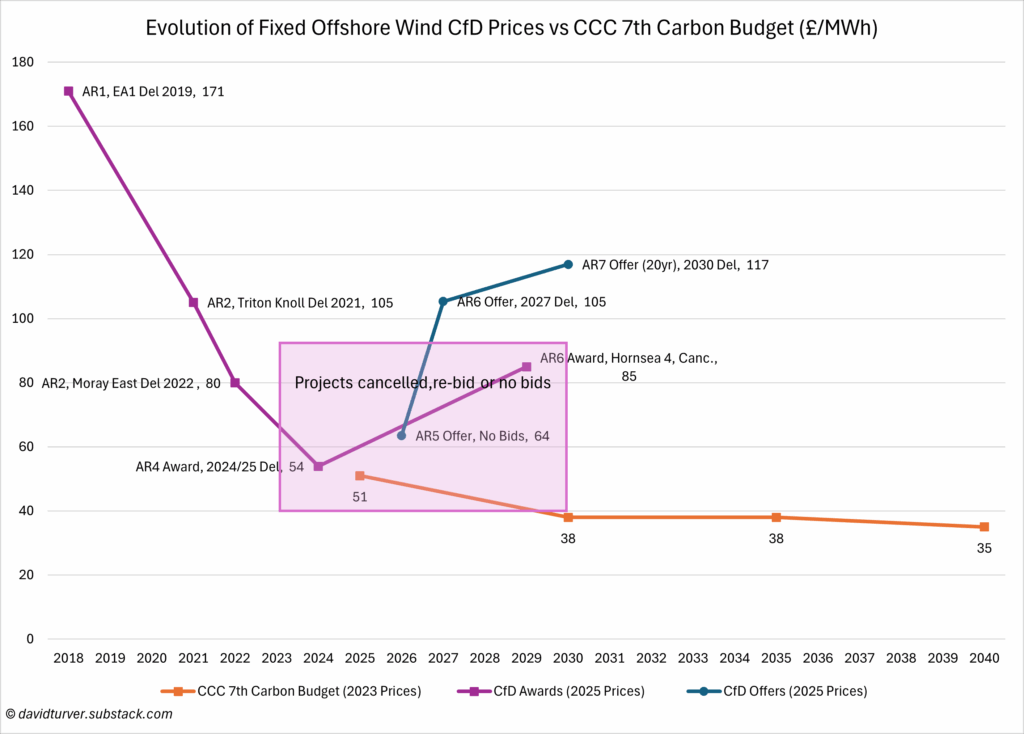

In her letter, Claire Coutinho noted that CB7 assumed that offshore wind will cost just £38/MWh in 2030. This is less than half the £82/MWh agreed in last year’s Allocation Round 6 (AR6) auction for Contracts for Difference (CfDs) and less than a third of the £117/MWh on offer in this year’s AR7 auction. She also noted that all CfD prices are index-linked, so go up each year with inflation, and in AR7 the contract terms have been extended by five years to 20 years.

Coutinho went on to express concern that the costings the CCC have published do not reflect reality and risk misleading Parliament and the public about the true cost of decarbonising electricity supply. Finally, she urged Topping to correct the costings before Parliament votes on CB7.

The full text of Coutinho’s letter can be found on the download below:

Coutinho Letter to Chair of CCC Nigel Topping, August 2025

Topping’s Response

Topping’s response highlights that there is a difference between the Levelised Cost of Energy (LCOE) used in CB7 and CfD strike prices. He claims that LCOE reflects the underlying cost of generating electricity over a project’s full lifetime, whereas strike prices reflect “a policy-determined revenue guarantee” for a contract period. He justifies using LCOE models instead of actual market data because it enables them to give comparisons across all technologies.

He goes on to say that the CCC applied a temporary 25% uplift to their cost estimates to reflect supply chain constraints. They then estimate that costs decline as learning improves and economies of scale kick in. In the latter part of the letter, Topping acknowledges the importance of making electricity cheaper and reiterates the need to remove levies and policy costs from bills. Finally, he tries to build bridges with Coutinho by noting they are both mathematicians and should have a lot to talk about.

The full text of Topping’s letter can be found on the download below:

CCC letter to Shadow Secretary Of State on energy prices in the Seventh Carbon Budget

Levelised Cost Models are Junk

Perhaps the most alarming thing about Topping’s response is that the CCC uses Levelised Cost models in preference to actual market data from competitive auctions. The CCC made a great play (main report p88) of the total net cost of Net Zero being “only” £110 billion over the period from 2025 to 2050. This overall cost relies on both the low capital expenditure estimates for renewables and solar, and the low energy prices from their LCOE models driving adoption of low-carbon technologies and savings for consumers. It is also worth noting that the cost of capital used in CB7 is only 3.5%, while the cost of capital used for fixed-bottom offshore wind in the latest AR7 strike prices is 8.5% and 10.9% for floating offshore wind.

Contracts for Difference, by contrast, reflect real-world market data from companies bidding in a competition. They also reflect the cost of renewables that we bear in our energy bills. The “policy-determined revenue guarantee” is necessary to persuade real companies to part with real cash to build these monstrosities. However, even the 15-year index-linked revenue guarantees offered in earlier rounds have not been enough to ensure success, as shown in Figure 1.

Norfolk Boreas, awarded a contract at very low prices in AR4, has been cancelled and the other projects have been partially re-bid at higher prices. AR5 received no bids for offshore wind. Hornsea 4, the flagship project for AR6, was awarded a contract at £85/MWh in today’s money, more than double the CCC’s estimate for 2030, and has been cancelled as uneconomic. AR7 projects are being offered 20-year contracts at prices above the £105/MWh currently being paid to Triton Knoll, which won a 15-year contract in AR2 and activated its CfD in 2021. Not much sign of learning curve improvements there.

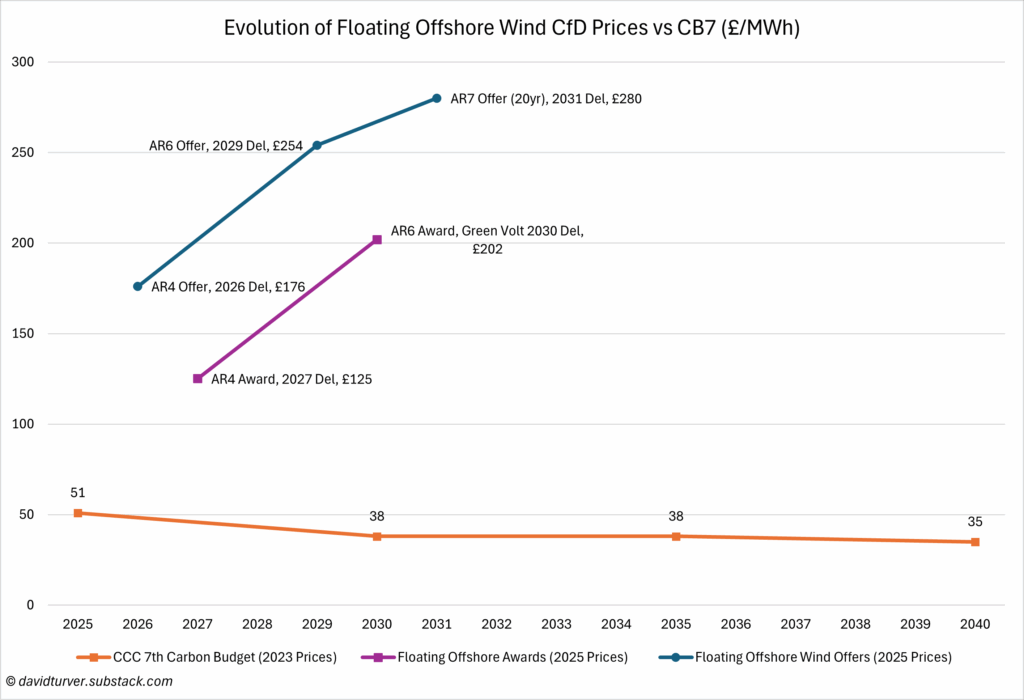

The CCC did not even mention the costs of floating offshore wind in their report, even though significant deployment of this technology will be needed to hit their capacity targets. The evolution of floating offshore wind costs is shown in Figure 2:

Green Volt won a contract in AR6 at £202/MWh in today’s money, more than five times the CCC’s estimate. Floating offshore wind contracts are being offered at £280/MWh in 2025 prices in AR7, more than seven times the CCC’s estimate.

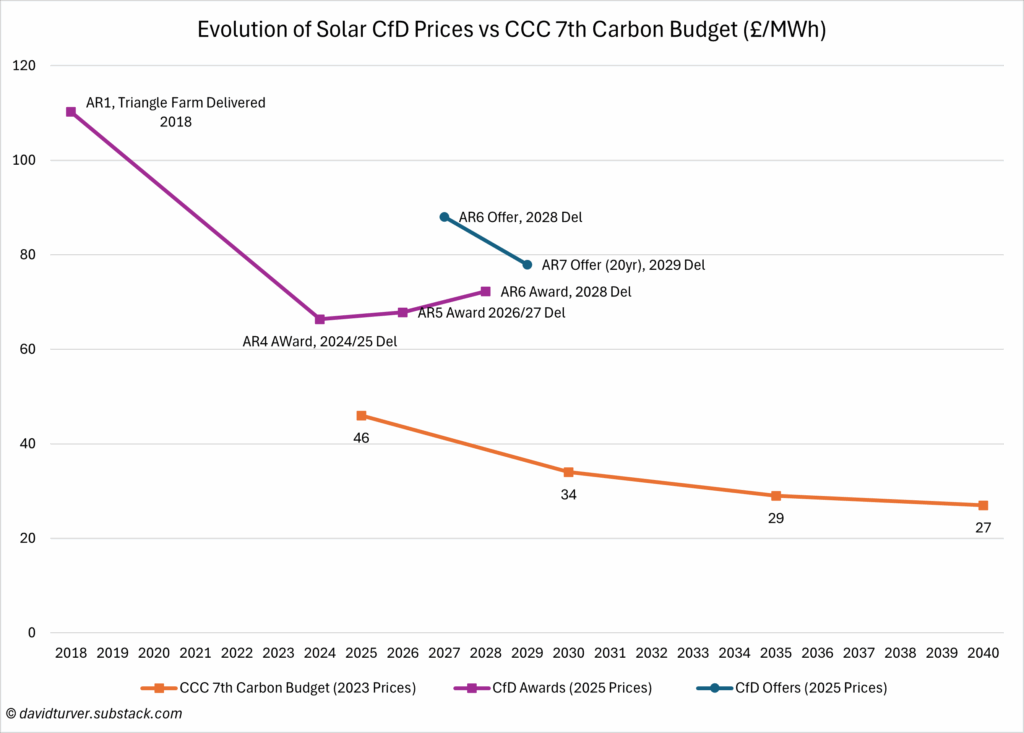

Although not mentioned in Claire Coutinho’s letter, the CCC was similarly optimistic about the costs of solar power, as shown in Figure 3:

The AR6 contract awards at £72/MWh at 2025 prices are more than double the CCC’s estimate of £34/MWh for 2030 delivery. The 20-year contracts on offer for AR7 are even more expensive at £78/MWh.

CCC Capital Costs are Unrealistic

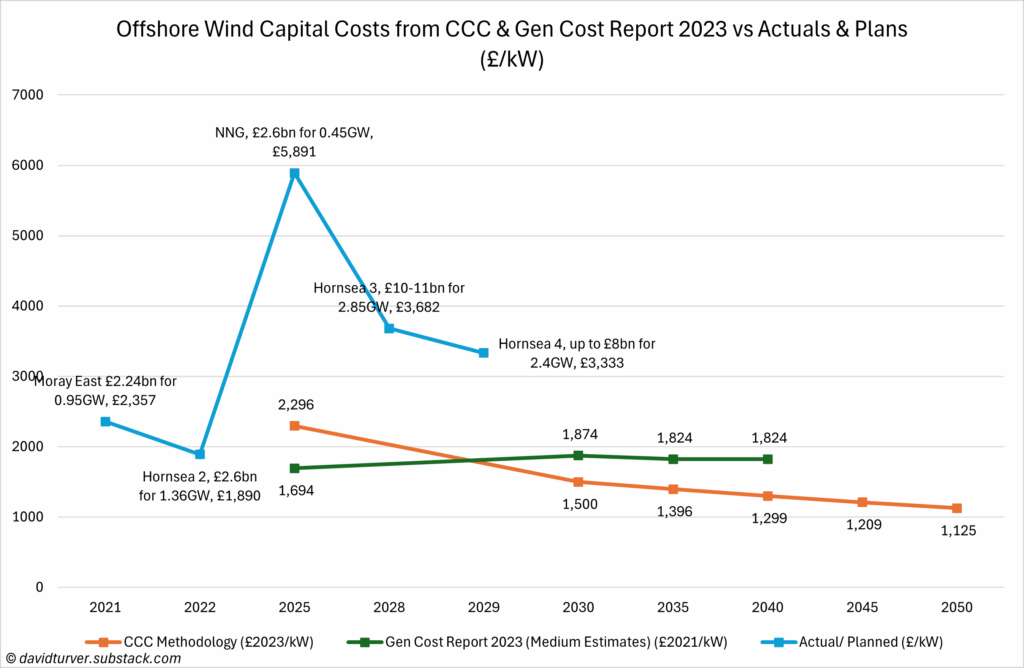

One of the reasons why the CCC’s estimates of the cost of electricity are so wrong is that they use capital cost estimates from the realms of fantasy. Figure 4 shows a range of actual and planned cost estimates for UK offshore wind farms and compares them to the CCC estimates in their technical annex.

The CCC estimates capital costs for offshore wind projects of £2,296/kW for 2025 delivery, falling to £1,125/kW by 2050. They were not too far out if comparing to projects like Moray East and Hornsea 2. However, NNG has recently come online after a difficult build and cost £2.64 billion (including OFTO) and delivered 448MW of capacity for a cost of £5,981/kW. Hornsea 3 (2.9GW) scheduled to come online in 2028 is forecast to cost £10–11 billion, for a mid-point of £3,682/kW. The Planning Inspectorate forecast the 2.4GW Hornsea 4 project would cost £5–8 billion in 2021. Hornsea 4 was recently cancelled by Orsted, so the costs have likely ballooned above even the high estimate that would have meant a cost of £3,333/kW, or more than double the CCC’s estimate for 2030 delivery. Floating offshore wind is even more expensive; Greenvolt won a contract for a 400MW floating wind farm in AR6 for delivery in 2028/29 that is forecast to cost £2.5 billion, or £6,250/kW. This is more than four times the CCC’s £1,500/kW estimate for 2030 delivery of offshore wind.

Perhaps Mr Topping would like to exercise his mathematical skills to work out how Hornsea 3, forecast to cost £10–11 billion for 2,852MW of capacity with an average strike price of ~£60/MWh (2025 prices), is ever going to make any money. With that capacity, strike price and an assumed load factor of 42%, annual revenue will be ~£630 million. Not enough even to pay the interest above 6.3% on £10 billion of debt, let alone begin to pay down the capital, and that’s before deducting any operating costs. No wonder Orsted is struggling to find a farm-out partner. There is not a hope in hell that offshore wind farms producing power at £38/MWh will ever be economic, so they will never get built.

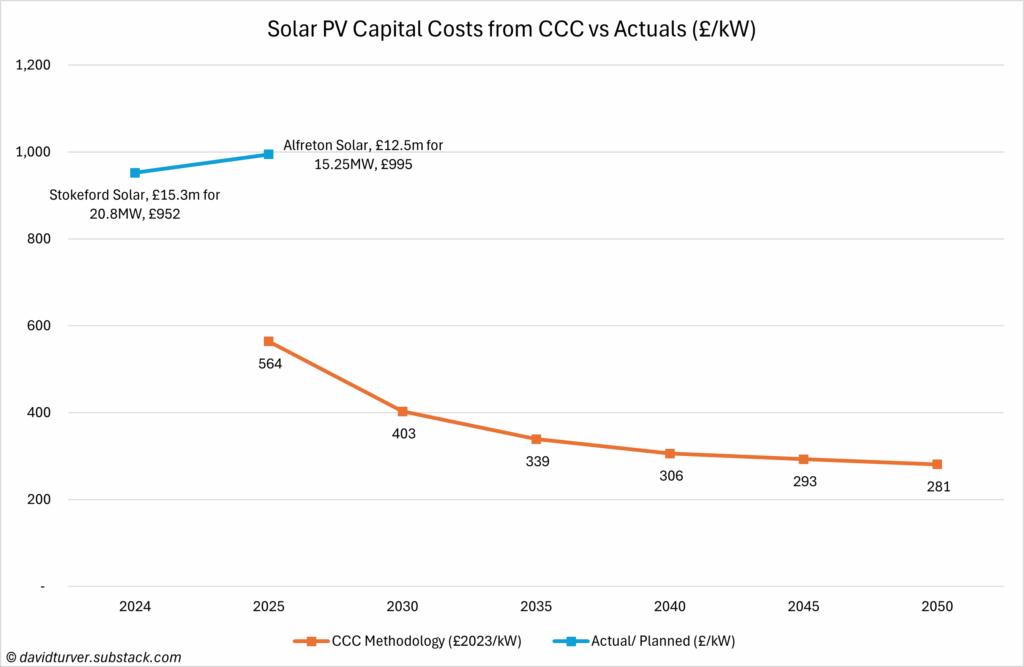

The CCC estimates for the capital costs of solar power are also in cloud cuckoo land, as shown in Figure 5:

Both Alfreton and Stokeford solar farms were awarded contracts in AR4 and activated their CfDs earlier this year. We now have the 2024 accounts for both projects and we can see that Stokeford has spent £952/kW and Alfreton some £995/kW, both almost double the CCC’s estimate of just £564/kW for 2025 delivery. The cost of panels may continue to fall, but the cost of the panels is becoming a very small proportion of the overall installation costs, so the chances of the CCC’s estimate of costs halving by 2050 is simply pie in the sky.

The CCC’s model of the cost of Net Zero relies on their ridiculously low capital cost estimates delivering unrealistically low electricity prices. Realistic capex estimates will increase the up-front costs, and sensible estimates for the cost of electricity mean their assumed operational savings out to 2050 will simply evaporate. Their entire model is built on fantasies and untruths.

Nigel Topping was not in post when CB7 was published, so is not to blame for the initial report. However, in his first public letter he has backed the findings of CB7 and doubled down on the flawed model at its heart. It might have been possible to blame the original publication on mistakes made by innumerate arts graduates, but after publicly boasting of his mathematical prowess, he is now complicit in the big lie underpinning Net Zero.

The CCC implicitly admits that renewables are expensive by calling for what they euphemistically call levies and policy costs to be removed from electricity bills. These are subsidies for renewables that the CCC said in its 4th Carbon Budget should be “forced on the market whether cost effective or not”. Now they want to cover up their earlier mistakes and bury the costs in general taxation or transfer them on to gas bills.

Doubling down on junk models, ignoring the costs of real projects, calling for the costs of renewables to be hidden and effectively misleading Parliament and the country demonstrate a truly staggering level of deceit. We must be getting close to triggering charges for misconduct in public office.

David Turver writes the Eigen Values Substack page, where this article first appeared.

Nigel Topping has proved himself as an expert in obfuscation. I was surprised to see that Emma Pinchbeck is still involved as CEO, she has proved herself unable to do arithmetic, just like her boss Ed Miliband.

All lunacy. Having just got a bill for two people which is more than double the usual bill of a year ago I would like to zero crazy politicians and net zero cultists.