Is Trump Embracing Europe's Energy Suicide?

Russian oil sanctions imitate Europe's failed moralistic policies

Lenin’s aphorism — “there are decades when nothing happens, and weeks when decades happen” — has seldom felt more apt. Since the Trump-Putin summit in Alaska three months ago, global energy geopolitics has convulsed in a series of dizzying turns that have left analysts and investors alike struggling to keep pace. The meeting that was hailed as a bold attempt to initiate peace in Europe, ‘reset’ US-Russia relations and stabilise energy markets has instead opened a Pandora’s box of further US sanctions on Russia and recriminations of Putin by Trump.

After raising hopes of possible peace for Ukraine when President Trump announced that he would soon be meeting his Russian counterpart President Vladimir Putin in Budapest, he then announced just a few days later that work on a second summit had halted. The abrupt cancellation of the proposed Budapest meeting suggests that US-Russia diplomacy has collapsed for the foreseeable future. Instead, the US seems to have adopted the maximalist demands of its European allies and is once again calling for immediate unconditional ceasefire. The US-Russia confrontational temperature was raised another notch by the ramping up of US sanctions on Russia that went well beyond what the previous Biden administration had invoked.

The Alaska Gambit

At the Alaska summit, Donald Trump and Vladimir Putin struck what appeared to be a pragmatic understanding. Trump, reverting to his businessman instincts, signalled that Washington would support negotiations to end the Ukraine conflict on terms acknowledging battlefield realities. This meant, in plain language, that Kyiv would have to cede territory to Moscow and remain a non-NATO neutral country. The “unconditional ceasefire” demanded by European leaders and the Biden-era foreign-policy establishment was, Trump argued, “unrealistic given the battlefield situation” and hinted at land-swap ideas as the way forward to a negotiated peace.

Putin, for his part, floated the prospect of joint US-Russian ventures to explore the immense oil and gas reserves of Russia’s Arctic. The Wall Street Journal reported that senior ExxonMobil executives were in secret talks with Rosneft to return to the massive Sakhalin project – a joint venture which was abandoned after Russia’s invasion in 2022 – after having been given the green light by US authorities as part of the Ukraine peace process. President Putin also offered US businesses an opportunity to launch joint ventures to exploit Russia’s vast reserves of critical minerals and rare earth metals.

For a moment, the global energy markets exhaled. Oil prices softened a little in the immediate aftermath of the Trump-Putin Alaska summit on August 15th 2025, with Brent crude and WTI futures declining by 1-2% over the following day or two. This dip was attributed in part to optimistic signals about potential US-Russia energy collaborations, including joint ventures in the Arctic. The mood was one of cautious optimism — until it wasn’t.

From Alaska to Budapest — and Back to Sanctions

Within weeks, Washington’s mood soured. Reports emerged of new Russian offensives near Pokrov, with Western media framing them as proof that Putin had used the Alaska talks as a smokescreen. Russia hawks in the Trump administration – Secretary of State and (acting) National Security Advisor Marco Rubio and Special Envoy Keith Kellogg and Republican congressmen such as Senator Lindsey Graham – seemed to have little time for negotiations on terms outlined in the Alaska summit.

The White House leaked plans to supply Kyiv with Tomahawk nuclear-capable cruise missiles, a move possibly designed to placate the hawks in Washington DC and Brussels but guaranteed to provoke Moscow. Predictably, Putin said that it would constitute a severe escalation requiring direct participation of US military personnel — implying it would cross a red line akin to direct aggression.

In response, Trump, in a characteristic burst of frustration, told reporters he was “disappointed” with Putin and was “re-evaluating” the entire diplomatic process. Then came the Budapest debacle. Trump cancelled what was to have been a follow-up summit — one he had personally proposed just a few days before — and, in a twist of theatrical self-contradiction, imposed sweeping new sanctions on Russia’s two major oil producers, Rosneft and Lukoil. According to Bloomberg, it was Rubio who finally convinced President Trump to take “ownership” of the US proxy war on Russia and place the sanctions on Russia’s oil companies. Henceforth, President Trump can no longer call it “Biden’s war” with any shred of credibility.

Treasury Secretary Scott Bessent said that: “Given President Putin’s refusal to end this senseless war, Treasury is sanctioning Russia’s two largest oil companies that fund the Kremlin’s war machine. We encourage our allies to join us in and adhere to these sanctions.” It was as if the Alaska summit which had initially signalled a tentative meeting of minds between Trump and Putin to step away from the maximalist position of ‘immediate unconditional ceasefire’ – pushed by Ukraine’s Zelensky and Brussels – was scrubbed from memory. The same administration that had, only weeks earlier, promised a new era of pragmatic engagement had reignited the sanctions war with a vengeance.

From the Kremlin point of view, this was a familiar pattern: Western flirtation followed by betrayal, as in the affair over the Minsk accords which Angela Merkel later admitted was a ruse to buy time for Ukraine to be armed by NATO. For the rest of the world — particularly the Global South — it was confirmation that the so-called ‘rules-based order’ had become a synonym for Western hypocrisy and chaos in global energy markets.

Rosneft is Russia’s largest oil company by production (40% of national output), followed by Lukoil (15-20%). Together they account for a significant 5% of global output. At the limit, using broad estimates of demand elasticity for oil, a complete stop to oil production by the two companies would lead to a price shock of 25- 30% in the short run. Brent at around $65 per barrel currently would jump up to $80-$85, a major shock. In the event, markets reacted to the US sanctions with initial jitters but quickly stabilised, as traders anticipated ‘workarounds’.

The continued use of Russia’s so-called ‘shadow fleet’ (i.e., those vessels not insured by Lloyds of London) and use of non-dollar settlements by Indian and Chinese oil companies working via proxies has evidently obviated the EU’s 19 sanctions packages over the past three years, resulting in relatively limited impact on the Russian economy or its energy exports. A full cessation of oil exports by Russia’s two major oil companies is unlikely and ‘limited flows’ via non-direct channels will persist, balancing energy security with compliance risks.

Europe’s Moral Grandstanding — and Energy Suicide

While Washington swung from conciliation to confrontation with Russia, Brussels marched steadfastly towards self-harm as it has over the past two decades in pursuit of its delusions of eco-socialism. While US big tech firms are looking at reviving dormant nuclear units at Three Mile Island and elsewhere in the country for their datacentre needs, Germany’s green-obsessed government is imploding mothballed nuclear plants to ensure that they can never be revived. On October 25th, two cooling towers at the former Gundremmingen nuclear power plant in Bavaria were demolished, almost four years after the last reactor was shut down.

With electricity prices at triple the US level and the highest in Europe, Germany’s de-industrialisation is gathering terminal velocity. Following essentially zero GDP growth since 2018, corporate bankruptcies in Germany have reached their highest level in a decade, with 11,900 insolvencies recorded in the first half of 2025, a 9.4% increase compared to the same period in 2024.

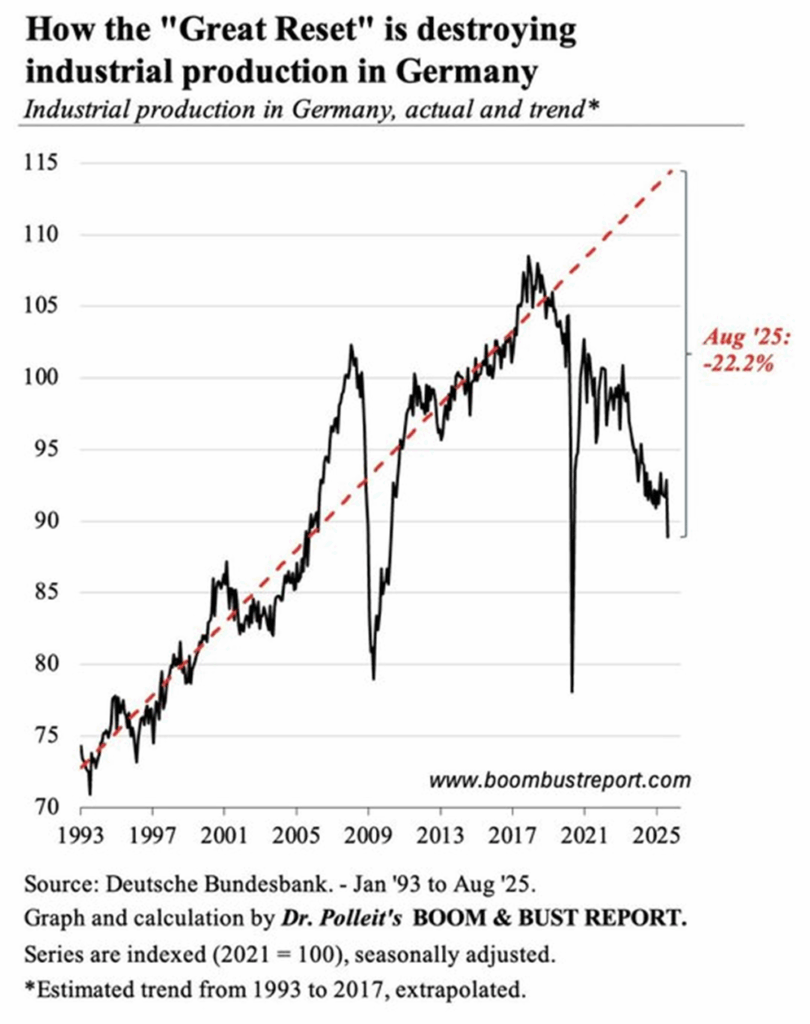

Europe’s economic powerhouse now has automakers – one of its core sectors – on their knees. Its most iconic car manufacturers are collapsing. Porsche’s operating profit has dropped by 99% in 2025, falling from approximately €4 billion to just €40 million. Its parent company, Volkswagen AG, has no money to produce new car models due to cash flow problems and a shortfall of €11 billion for next year. By August 2025, Germany’s industrial production was over a fifth smaller than the trend over 1997-2017 would have predicted.

Germany’s latest public embarrassment, and a sign of its increasing geopolitical irrelevance, was paraded when German Foreign Minister Johann Wadephul on Friday postponed an imminent diplomatic trip to China, over “a dearth of meetings” on his schedule. China is now Germany’s largest trading partner. In plain English, the Chinese said, ‘don’t bother coming’, after being subject to hectoring by bumptious German leaders on the Taiwan issue, economic relations with Russia and other matters such as China’s ‘blocking of semiconductor shipments to Europe’. In August, Wadephul had proclaimed that China was providing “crucial” support to Russia, enabling President Vladimir Putin’s ongoing war against Ukraine.

Yet another arrow in Europe’s moral quiver concerns ‘corporate social responsibility’ or ESG. The European Commission’s latest proposal for corporate-responsibility codes contained in its Corporate Sustainability Due Diligence Directive would require all firms operating in the EU to document the “human-rights” and “climate-impact” credentials of their entire global supply chains. In practice, this meant that energy companies would have to disclose not just emissions data but political affiliations and labour practices across multiple jurisdictions.

The reaction from producers was swift and scathing. In an extraordinary joint communiqué issued last week, the US Department of Energy and Qatar’s Energy Ministry warned that they could “reconsider LNG supply commitments” if the EU persisted with its intrusive regulatory regime. The world’s two largest natural gas producers were on the same page — defending the sanctity of commerce against Brussels’s moral imperialism.

Yet the EU seems determined to press on. European Commission President Ursula von der Leyen, invoking the “strategic autonomy” mantra, has pledged to end all dependence on Russian oil and gas by end 2027 — a goal that is as unlikely as it is self-defeating. Despite 19 rounds of sanctions and a significant decline in trade volumes since 2022, the bloc remained Russia’s third-largest trading partner in 2024, after China and India.

Even sympathetic observers now admit that Europe’s decarbonisation zeal has outpaced its economic common sense. The ‘Green Deal’, conceived in the salons of Brussels, is meeting the cold reality of physics and finance. Energy cannot be legislated into existence; it must be produced, transported and consumed — and for that, hydrocarbons, the substrate of civilisation, remain indispensable.

The BRICS Counter

While the Atlantic powers engage in the escalation of war rhetoric against Russia à la Zbigniew Brzeziński’s “grand chessboard” of American primacy and its geostrategic imperatives, the rest of the world is starting to decouple from the Western alliance. Russia, China and India have accelerated their energy integration, trading crude and LNG in yuan, rupees and dirhams rather than dollars. BRICS nations have been discussing a basket-based settlement currency to bypass the Western financial system since 2022, having witnessed the total economic war that the Western alliance had unleashed on Moscow including the freezing of its foreign exchange assets worth over $300 billion. For Russia, this is both necessity and opportunity: sanctions and the seizing of its financial assets in Western capitals have forced deep import substitution, re-direction of trade flows and innovation. With the shift to multipolarity, the de-dollarisation trend has gained momentum.

India’s Energy Minister, Hardeep Puri, recently dismissed Washington’s threat of secondary sanctions as “coercive unilateralism”. New Delhi continues to buy discounted Russian oil, refine it and re-export the products — often to the same European markets that claim to boycott Russia. With the latest US sanctions, however, Indian refiners are adjusting their volumes of Russian purchases to avoid the risk of retribution by US authorities.

Beijing, meanwhile, has become Moscow’s indispensable partner. Bilateral trade is now dominated by energy and technology exchanges settled in yuan. When asked to comment on the Trump administration’s move to impose sanctions on two major Russian oil companies, Chinese Foreign Ministry spokesperson Guo Jiakun said on Thursday that China opposes unilateral sanctions, which lack a basis in international law and UN Security Council authorisation. There is no credible scenario where China kowtows to imperious American demands on the shape of its political and economic relations with Russia.

This Eurasian realignment underscores the central paradox of Western sanctions: the more they are deployed, the less effective they become, as warned by Gita Gopinath, the IMF’s Chief Economist. Each new sanctions package merely accelerates the fragmentation of the global economy into competing blocs and chips away at US dollar dominance. What was once a unipolar system anchored by the Bretton Woods system, the dollar and NATO is morphing into a multipolar order driven by resource pragmatism and regional resilience.

For President Donald Trump, the consequences are immediate and personal. With mid-term congressional elections looming, rising fuel prices could prove politically fatal. American motorists are unforgiving: $5 gasoline at the pump has sunk Presidencies before. Trump’s own base — the working-class voters who rallied to his promise of “energy dominance” and no more “forever wars” — now watch in dismay as the administration’s erratic sanctions and mixed signals destabilise markets and risk escalating wars.

The irony is stark. By sanctioning Russian oil companies and flirting with punitive tariffs on Chinese imports, President Trump risks replicating the inflationary spiral that he blamed his predecessor for. The Federal Reserve can do little to offset supply shocks driven by geopolitics. A tightening of global oil supply by US sanctions, compounded by Europe’s moralistic policies and OPEC’s cautious output stance, could send prices soaring into the 2026 election season.

The Long Arc of Energy Realpolitik

The events since the Alaska summit encapsulate the contradictions that have enveloped President Trump’s nine months in power in his second term. European and UK leaders insist on their moral posturing, unable to reconcile their rhetoric of ‘climate justice’ with the material realities of industrial civilisation. Simultaneously, they claim the imperative to ‘defeat’ Russia. Trump’s instinct to pursue pragmatic engagement with Russia was sound in principle — economic and energy cooperation is the surest path to peace — but his execution was undone by domestic politics and war hawks in his own administration as well as by US allies in Europe (with significant exceptions like Hungary and Slovakia which refuse to dance to Brussels’s globalist tune).

President Putin plays the long game. He knows that Europe’s pledge to wean itself off Russian energy has boomeranged on its executioners. Geography and thermodynamics are on his side. Even if Brussels cuts direct imports, Russian molecules in a fungible trade will continue to flow through intermediaries — refined, rebranded, relabelled but ultimately Russian.

As the proposed Budapest summit collapsed in recrimination and sanctions tighten once more, the world confronts a hard truth: there can be no stable global energy order without cooperation among its major producers. Trump’s Alaska initiative, for all its flaws, at least recognised this. His subsequent retreat — under pressure from Washington’s hawkish foreign-policy establishment and Brussels— marks yet another missed opportunity to bridge the East-West divide through shared material interests.

Europe’s bureaucrats, meanwhile, continue to legislate against physics, demanding energy without emissions and growth without natural resources. The result is predictable: industrial decline, political unrest, establishment attacks on increasingly popular ‘far Right’ conservative opposition parties and a steady erosion of global influence. For those who still believe that the West can dictate the terms of global energy exchanges, the past three months offer a stark reminder. The world has changed; in a multipolar world, power now resides where the resources are and what battlefield realities determine, not where the moralistic lectures come from.

Lenin’s decades have indeed happened in months if not weeks — and unless Western leaders rediscover the virtues of realism over rhetoric, of realpolitik over hypocritical moralism, the next few weeks and months may bring decades more of continued Western decline.

Dr Tilak K. Doshi is the Daily Sceptic‘s Energy Editor. He is an economist, a member of the CO2 Coalition and a former contributor to Forbes. Follow him on Substack and X.